This post discusses the Value at Risk (VaR) measure used in financial markets, including the variance-covariance method, marginal VaR, component VaR, and then analyze the risk profile of a real portfolio.

Introduction

Value at Risk (VaR) is widely used by financial institutions to measure market risks or potential investment losses. It tells the maximum possible loss for a given portfolio over a certain time horizon, with a certain confidence level \(\alpha\), or

\[ Pr(Loss \le -VaR)=1-\alpha \tag{1.1} \]

There are three approaches to calculate VaR, that is, historical simulation, variance-covariance, and Monte Carlo simulation.

If you have difficulty viewing the formulas, right click on it and select Math Settings Math Renderer to switch to another format.

In this post we explore the variance-covariance method, or the delta-normal method, for VaR, Marginal VaR, and Component VaR. Consider a portfolio of n assets with corresponding weights w and covariance matrix \(\Sigma\), then the value this portfolio V, and its return and risk are

\[ \begin{matrix} V&=&\sum_{i=1}^{n} V_i\\ r_p&=& w^T\cdot r \\ \sigma_p^2 &=& w^T\Sigma w \end{matrix} \tag{1.2} \]

Assuming return normality, The value at risk of the portfolio in dollar amount is

\[ VaR_p = z\sigma_pV \tag{1.3} \]

where z is the inverser normal of confidence level \(\alpha\). For example, if \(\alpha\)=5%, then z=NORMSINV(0.95)=1.645 by Excel spreadsheet. Similarily, we can look at each individual stock and define its value at risk. Due to portfolio diversification, the portfolio VaR will be smaller than the sum of each individual VaR.

\[ \begin{matrix} VaR_i=z\sigma_i V_i \\ VaR_p \lt \sum_{i=1}^{n} VaR_i \end{matrix} \tag{1.4} \]

A natural question then is if we can normalize VaR so that the VaR of all the component stocks sum up to exactly the VaR of the portfolio? This is the concept of Marginal VaR (MVaR) and Componenet VaR (CVaR).

Marginal VaR is defined as derivative of portfolio w.r.t the per unit dollar change in value of the component stock, or

\[ MVaR_i=\frac{\partial VaR_p}{\partial V_i} = \frac{\partial z\sigma_pV_p}{\partial w_iV_p}=z\frac{\partial \sigma_p}{\partial w_i}=z\frac{\sigma_{ip}}{\sigma_p} \tag{1.5} \]

where \(\sigma_{ip}\) is the covariance between ith asset and portfolio p, and the last equation uses the following fact that,

\[ \begin{matrix} \frac{\partial\sigma_P}{\partial w_i} &=& \frac{[ \sum_{i=1}^{n} w_i^2\sigma_i^2 + \sum_{i=1}^n \sum_{j=1, j\ne i}^{n} w_iw_jc_{ij} ]^{1/2} } { dw_i } \\\\ &=& \frac{1}{2} [ 2w_i\sigma_i^2 + 2 \sum_{j=1, j\ne 1}^{n} w_jc_{ij} ] \times [ \sum_{i=1}^{n} w_i^2\sigma_i^2 + \sum_{i=1}^n \sum_{j=1, j\ne i}^{n} w_iw_jc_{ij}]^{-1/2} \\\\ &=& \frac{w_i^2\sigma_i^2 + \sum_{j=1, j\ne 1}^{n} w_j c_{ij} } {\sigma_p} = \frac{c_{ip}}{\sigma_p} \end{matrix} \tag{1.6} \]

Note that return correlation and beta coefficient are respectively,

\[ \begin{matrix} \rho_{ip}=\frac{\sigma_{ip}}{\sigma_i\sigma_p} \\ \beta_{ip}=\frac{\sigma_{ip}}{\sigma_p^2} \end{matrix} \tag{1.7} \]

then Marginal VaR can be rewritten as

\[ MVaR_i=z\frac{\sigma_{ip}}{\sigma_p}=z\sigma_i\rho_{ip}=z\sigma_p\beta_{ip} \tag{1.8} \]

At last, Component VaR (CVaR) is defined as,

\[ CVaR_i=MVaR_i \cdot V_i \tag{1.9} \]

It holds nicely to the following relationship,

\[ \sum_{i=1}^{n}CVaR_i=\sum_{i=1}^{n}z\sigma_p\beta_{ip}w_iV=z\sigma_pV\{\sum_{i=1}^{n}w_i\beta_{ip}\}=VaR_p \tag{1.10} \]

Real Portfolio

To illustrate the VaR delta-normal model, we continue to use the portfolio in the post in portfolio optimization.

First, let's download historical data and estimate the covariance matrix from it

1 | assets = ['AAPL', # Apple |

Then we can calculate portfolio VaR, marginal VaR, and component VaR via equations (1), (3) and (4), respectively,

1 | # calculate historical log returns |

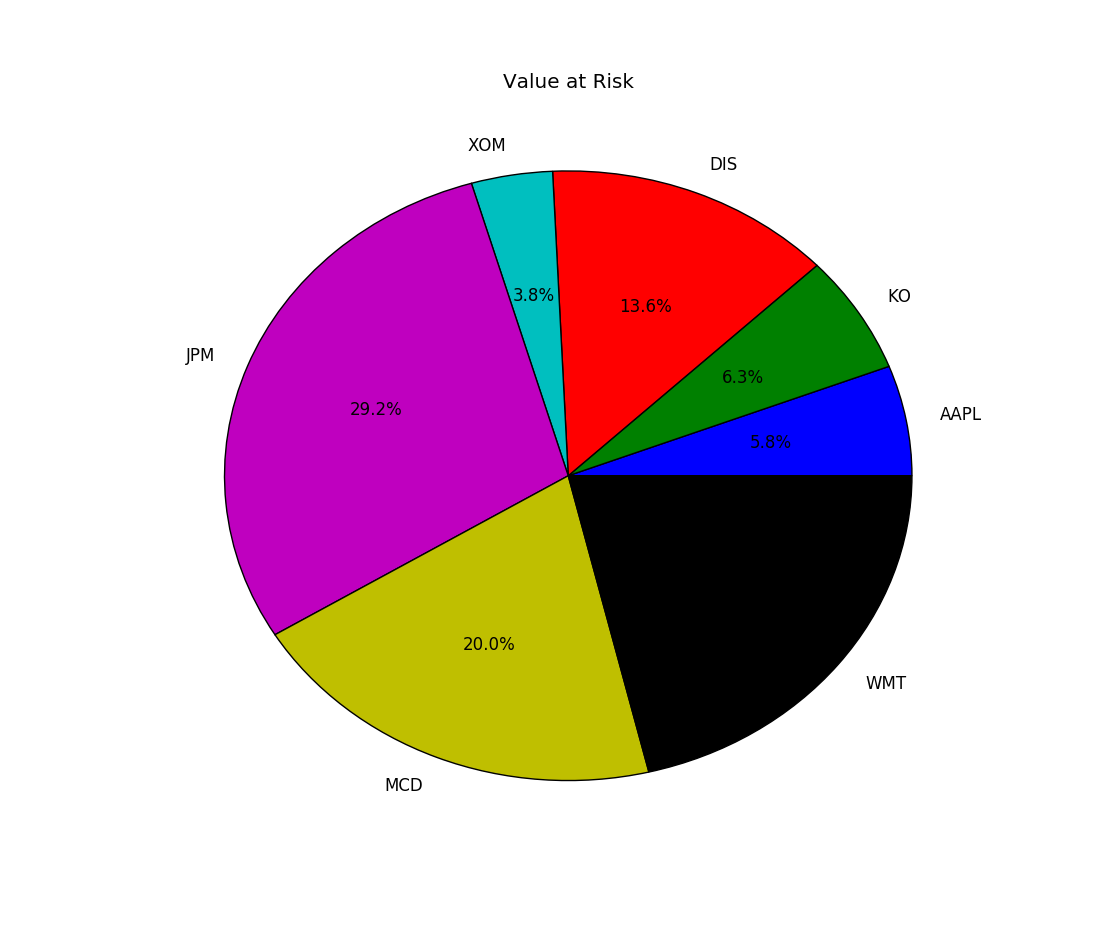

The compoenet VaR results are printed out as 1

2

3

4

5

6

7

8 Position ($) Position (%) CVaR ($) CVaR (%) Beta

AAPL 16923.0 0.057814 211.850987 0.058426 1.010597

KO 21502.0 0.073457 227.700358 0.062797 0.854889

DIS 32082.0 0.109601 493.220879 0.136025 1.241094

XOM 18352.0 0.062695 138.558105 0.038213 0.609499

JPM 86060.0 0.294004 1058.301425 0.291868 0.992734

MCD 59250.0 0.202414 726.546655 0.200373 0.989919

WMT 58548.0 0.200016 769.783563 0.212298 1.061405

We have chosen big companies with beta close to one. So their component VaRs are in line with their position weights.

DISCLAIMER: This post is for the purpose of research and backtest only. The author doesn't promise any future profits and doesn't take responsibility for any trading losses.